What the Experts Say:

“Opening a Roth IRA is the first step toward a secure financial future. Setting aside money today for your future retirement is one of the best financial moves you can make.”

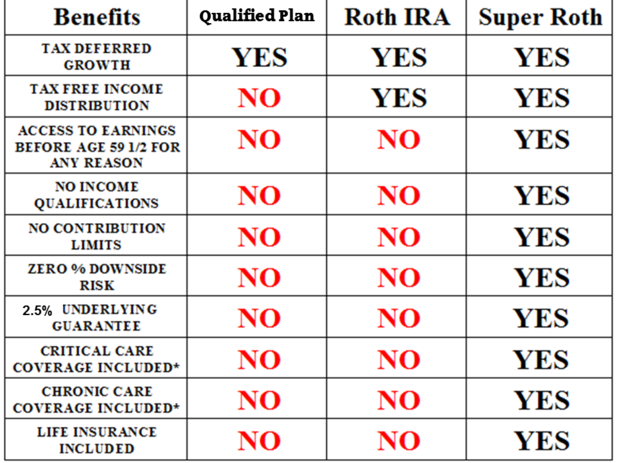

EXACTLY WHY ONE SHOULD LOOK INTO A SUPER ROTH!

Comparison Factors:

Chronic & Critical Coverage varies by state.*

The Super Roth

The super Roth is an Indexed Universal Life Insurance contract that is set up to comply with the following tax laws passed by congress:

- Tax Equity and Fiscal Responsibility Acts of 1982 (TEFRA)

- Deficit Reduction Act of 1984 (DEFRA)

- Technical and Miscellaneous Revenue Act of 1988 (TAMRA)

FUTURE INCOME TAX RATES!

Income tax rates would have to double across the income spectrum to balance the federal budget.

Source: The Heritage Foundation, Federal Budget in Pictures, 2012; using data from the Congressional Budget Office.

Note:The National Debt has more than doubled since 2012.

THE CURRENT NATIONAL DEBT!

"When it comes to saving for retirement, we have the 500 lb. Gorilla in the room that will provide the most benefits for you!"

How are you planning to put your retirement fund together?

The Super Roth is a great tool to help you meet your Goals!

Putting as much money as you can into a Super Roth designed to provide Tax Free Income during your Retirement can increase your current Retirement Income by 25% to 40% or more at no added cost to you!

Disclaimer

The Super Roth is a savings concept that may have legal, accounting, and tax implications. This website is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant.

Note: The Super Roth can only be provided to you by a State Licensed Life Insurance Agent.